Ubisoft Stock: A Rollercoaster Ride Amidst Assassin's Creed Shadows Release

As the gaming world buzzes with excitement over the release of Assassin's Creed Shadows, investors and industry analysts are closely watching Ubisoft's stock performance.

As the gaming world buzzes with excitement over the release of Assassin's Creed Shadows, investors and industry analysts are closely watching Ubisoft's stock performance. The French video game giant has faced significant challenges in recent years, with its market value experiencing a dramatic decline. However, the launch of their latest blockbuster title could potentially mark a turning point for the company. In this comprehensive analysis, we'll explore the current state of Ubisoft stock, the impact of Assassin's Creed Shadows, and what the future might hold for this embattled gaming powerhouse.

The Decline of Ubisoft's Market Value

Ubisoft's journey through the stock market has been nothing short of tumultuous. Once a titan in the gaming industry, the company has experienced a staggering decline in value over the past four years. From a market capitalization of $12.17 billion in 2021, Ubisoft's worth plummeted to a mere $1.78 billion by January 2025. This represents an alarming 85% drop in value, raising serious concerns among investors and industry observers alike.

Several factors have contributed to this decline, including underperforming game releases, increased competition in the gaming market, and broader economic challenges. The company's strategy of leveraging new intellectual properties for game development has not always paid off, with titles like "Avatar: Frontiers of Pandora" and "Star Wars Outlaws" failing to meet sales expectations.

Assassin's Creed Shadows: A Potential Game-Changer

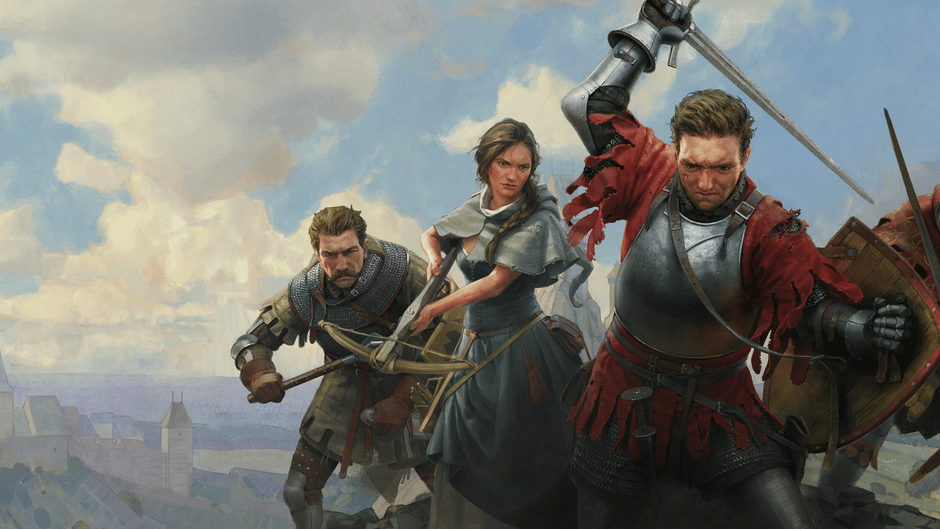

Enter Assassin's Creed Shadows, Ubisoft's latest entry in its flagship franchise. Released on March 20, 2025, this highly anticipated title has generated significant buzz in the gaming community. Set in feudal Japan, the game follows the journey of Yasuke, offering players a rich, historically-inspired open world to explore.

Early reviews have been largely positive, with critics praising the game's combat system, attention to detail, and ambitious scope. IGN awarded the game an impressive 8/10, stating that it "creates one of the best versions of the open-world style it's been honing for the last decade." This positive reception could translate into strong sales, potentially providing a much-needed boost to Ubisoft's financial performance.

Pre-Order Performance and Sales Expectations

Ubisoft CEO Yves Guillemot has expressed optimism about Assassin's Creed Shadows, revealing that pre-orders for the game are "in line with those of Assassin's Creed Odyssey." This is particularly encouraging, as Odyssey went on to sell over 10 million copies, becoming the second best-selling entry in the series. If Shadows can match or exceed these numbers, it could significantly impact Ubisoft's revenue and stock performance.

However, it's worth noting that the gaming landscape has changed since Odyssey's release. With increased competition and evolving player preferences, Shadows will need to perform exceptionally well to meet the high expectations set by its predecessors.

Current Stock Performance and Investor Sentiment

As of March 20, 2025, Ubisoft's stock price stands at $14.32, reflecting the challenges the company has faced in recent years. The stock has been in an uptrend since July 2001, but this long-term growth has been overshadowed by the significant drop in market capitalization since 2021.

Investor sentiment remains cautious, with many adopting a wait-and-see approach in light of Assassin's Creed Shadows' release. The success or failure of this title could have a substantial impact on Ubisoft's short-term stock performance and long-term financial outlook.

Challenges and Controversies

While Assassin's Creed Shadows has generated excitement, its launch has not been without controversy. The game has faced backlash on social media regarding its diverse character roster, reflecting broader societal debates about representation in media. Such controversies can potentially impact sales and, by extension, stock performance.

Additionally, Ubisoft continues to grapple with internal challenges. The company has implemented cost-reduction measures, including layoffs and studio closures, which have raised concerns about its long-term stability and creative output.

The Road Ahead: Predictions and Possibilities

Looking to the future, analysts offer mixed predictions for Ubisoft stock. Some forecasts suggest a modest increase to $14.443 after a year, representing a 0.86% growth. However, longer-term projections are less optimistic, with a potential decrease to $14.747 over five years.

These predictions underscore the uncertainty surrounding Ubisoft's future. While Assassin's Creed Shadows may provide a short-term boost, the company will need to address underlying issues to achieve sustained growth and regain investor confidence.

Potential for Acquisition or Strategic Partnerships

Amidst Ubisoft's struggles, rumors of potential acquisitions or strategic partnerships have circulated. The Guillemot family, Ubisoft's founders and primary shareholders, have reportedly been in discussions with Tencent and other investors regarding a potential buyout that would allow them to maintain control of the company.

While Ubisoft has not commented on these rumors, such a move could significantly impact the company's future direction and stock performance. Investors will be watching closely for any developments on this front.

The Importance of Diversification and Innovation

As Ubisoft navigates these challenging times, the importance of diversification and innovation cannot be overstated. While Assassin's Creed remains a crucial franchise for the company, relying too heavily on a single IP carries inherent risks.

To secure its long-term future and stabilize its stock performance, Ubisoft will need to continue developing new IPs, exploring emerging technologies like VR and cloud gaming, and adapting to changing player preferences. The success of these efforts will play a crucial role in determining the company's trajectory in the coming years.

Conclusion: A Pivotal Moment for Ubisoft

The release of Assassin's Creed Shadows marks a critical juncture for Ubisoft. With its stock price and market value at historic lows, the company is banking on the success of this latest title to reverse its fortunes. While early indicators are promising, the true impact of the game on Ubisoft's financial performance and stock value remains to be seen.

For investors considering Ubisoft stock, careful analysis and monitoring of the company's performance in the coming months will be crucial. The success of Assassin's Creed Shadows, coupled with Ubisoft's ability to address its underlying challenges and adapt to the evolving gaming landscape, will ultimately determine whether the company can reclaim its position as a leader in the industry.

As the dust settles on the launch of Assassin's Creed Shadows, all eyes will be on Ubisoft's next moves. Whether this marks the beginning of a turnaround or another chapter in the company's struggles, one thing is certain: the coming months will be pivotal in shaping Ubisoft's future and its standing in the competitive world of video game publishing.